The FDA Center for Tobacco Products (CTP) is being criticized for its enforcement efforts and with good reason. A new report of the Vapor Technology Association’s analysis of FDA’s enforcement data has revealed some striking findings that the FDA chooses not to synthesize for the public.

Since 2018, the FDA has spent presumably millions of dollars conducting more than 325,000 retail inspections resulting in a high compliance rate of 86% of inspections with “no violations” for the sale of tobacco products. Furthermore, 96% of FDA retail inspections used minors and the overwhelming majority of those inspections resulted in 85% with in “no violations”, again a high compliance rate.

Source: FDA Compliance Check Inspections of Tobacco Product Retailers database

The utility of CTP’s local enforcement efforts, aimed at youth sales and potential violations at retail stores, needs to be re-examined to determine whether they are worth the expenditure.

FDA Ignoring Combustible Tobacco Product Sales to Youth

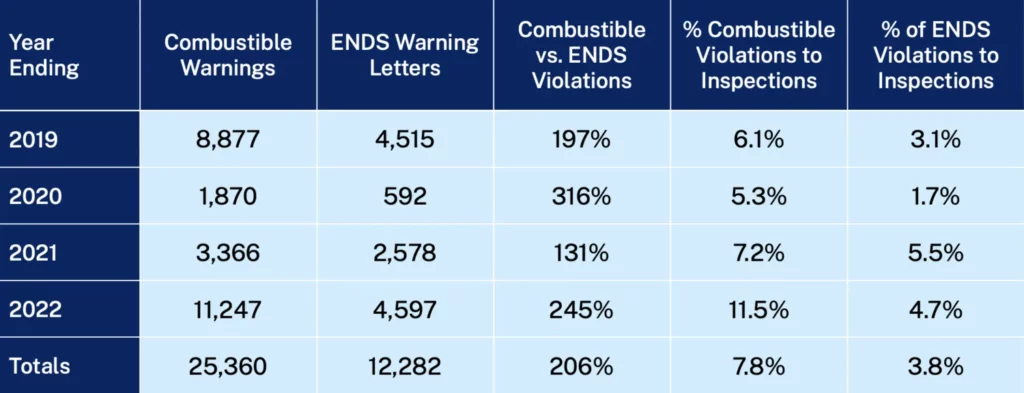

The FDA has been rightly criticized by leading tobacco-control scientists for focusing its narrative, policies and efforts on youth vaping and e-cigarette products, but the data shows that warning letters for youth sales violations involving nicotine vaping products only account for 3.8% of all retail inspections conducted since 2018. In comparison, warning letters for youth sales violations for combustible products were twice as high. In 2022 alone, the rate of combustible violations was two and a half times that of nicotine vaping products.

Source: FDA Compliance Check Inspections of Tobacco Product Retailers database

Moreover, FDA data reveals that penalties beyond warning letters for flagrant violations are imposed far more often for violations of combustible products than for vaping products.

The FDA’s continued refusal to publicly acknowledge that youth sales of combustible products are more than two times that of less harmful e-cigarette products raises serious questions about its purpose and intent.

FDA Ignoring the Fact that Vape Shops and Other Adult-Only Stores Have Best Compliance Rates

Our vaping association’s data has determined that FDA policies have, by design or effect, dramatically reduced the number of independent vape shops around the country since 2018 by 27%. This has occurred despite the fact that the FDA has known these stores have the best compliance rate.

However, VTA’s analysis of FDA data reveals that since 2018 adult-only retailers, such as vape shops, have been best at preventing unlawful sales to youth. While almost 78% of youth violations occurred at non-adult only stores, such as gas stations and convenience stores, only 21% of violations occurred in adult-only vape shops (5%) and tobacco shops (16%).

FDA Ignoring the Fact that Tobacco/Menthol E-Cigarettes Far Exceed Other Flavored Vape Sales Violations

FDA rarely makes any statement regarding vaping products without also warning about sales of flavored vaping products to youth. However, FDA’s data reveals that since 2018 youth sales violations of tobacco and menthol flavored vapes exceeded 55%, while sales violations involving other flavors lagged behind at 39%.

The FDA Center for Tobacco Products not only needs to question the resources it is spending to enforce against small businesses, but it needs to be truthful and transparent when it publicly characterizes the issues of youth vaping and retail sales.